FlyFin AI

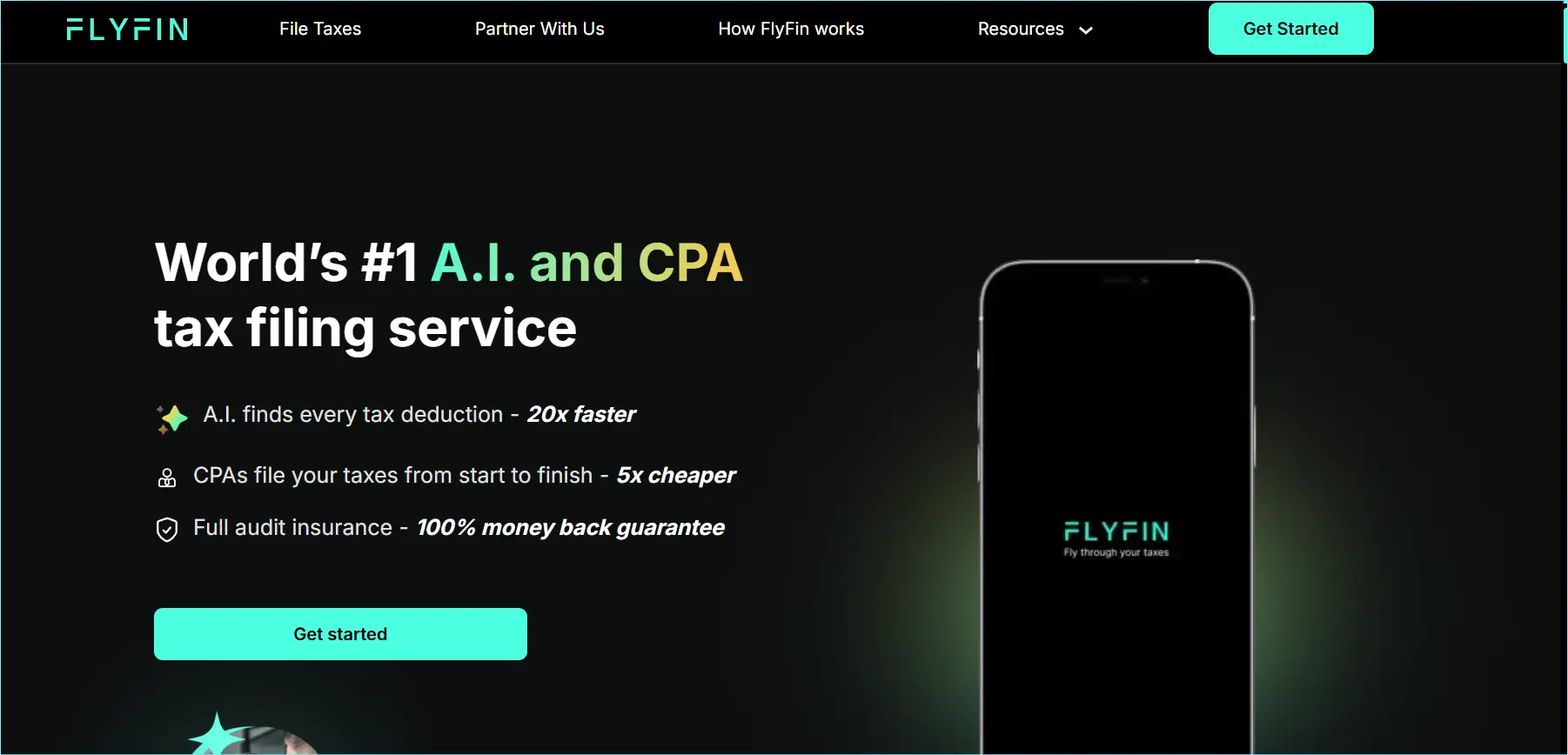

What is FlyFin AI?

FlyFin is an AI and CPA tax filing service for freelancers, gig workers, and self-employed individuals. FlyFin uses AI to scan expenses, find tax deductions, and track income. CPAs prepare and e-file federal and state returns. The platform includes audit insurance, a quarterly tax estimator, and a tax calculator. It supports 1099 tax filing, Schedule C, and self-employed tax planning.

How to use FlyFin AI

Connect expense accounts. AI scans for deductions. Upload documents based on your profile. CPAs prepare your return. Review and e-sign. CPAs e-file when ready. Use the app to ask tax questions and estimate quarterly payments.

FlyFin AI features

AI Deduction Tracker

Finds write-offs from 200+ IRS categories

CPA Tax Filing

CPAs prepare and e-file your taxes

Quarterly Tax Estimator

Estimates owed taxes using your deductions and income